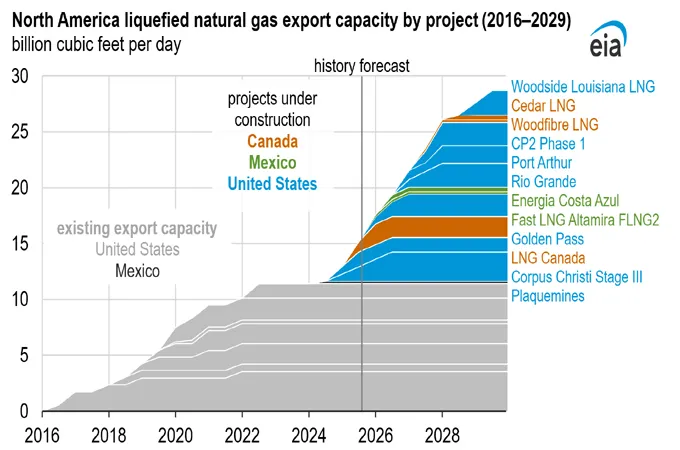

Liquefied natural gas (LNG) exporters in the US have announced plans to more than double US liquefaction capacity, adding an estimated 13.9 billion cubic feet per day (Bcf/d) between 2025 and 2029, according to US Energy Information Administration (EIA) Liquefaction Capacity File and trade press reports.

The US is already

the largest exporter in the world with 15.4 Bcf/d of capacity.

More broadly, LNG

export capacity in North America is on track to increase from 11.4 Bcf/d at the

beginning of 2024 to 28.7 Bcf/d in 2029, if projects currently under

construction begin operations as planned.

Exporters in Canada

and Mexico have announced plans to add 2.5 Bcf/d and 0.6 Bcf/d of capacity over

the same period, respectively.

North American export

capacity additions will total over 50 per cent of expected global

additions through 2029, according to the International Energy Agency.

US: The planned

liquefaction capacity additions will be concentrated around the US Gulf Coast,

already the largest hub for LNG exports in the Atlantic Basin.

To supply these

terminals, new pipeline projects will be built to transport natural

gas from production areas. However, pipeline construction delays remain a

supply risk for new terminals.

Plaquemines LNG Phase

1 shipped its first cargo in December 2024.

Plaquemines LNG Phase 2 and Corpus

Christi Stage III began shipping cargoes earlier in 2025, but they have

not yet begun commercial operation.

Five additional LNG

export projects in the US have reached final investment decision (FID)

and are currently under construction:

Canada: On July

1, LNG Canada—the nation’s first LNG export terminal—shipped its first cargo from

Train 1 after achieving first LNG production in late June.

LNG Canada, located in

British Columbia, can produce a combined 1.84 Bcf/d from two liquefaction

trains (0.9 Bcf/d per train), and the facility is anticipated to reach full

capacity in 2026.

A proposed second

phase of the project would double the export capacity to 3.68 Bcf/d and expand

the facility to four trains, according to the Canada Energy Regulator (CER).

The expansion is expected to come online after

2029.

Canada’s new LNG

capacity will be on the west coast of North America, reducing shipping

times to Asian markets by 50 per cent compared with exports from US Gulf

Coast terminals, and will source feedgas from the Montney Formation in the

western provinces of Alberta and British Columbia.

Two other projects with a combined capacity of

0.7 Bcf/d are currently under construction in Western Canada.

Woodfibre LNG, with an

export capacity of 0.3 Bcf/d, is expected to start LNG exports in 2027.

Cedar LNG—a floating

LNG project with capacity to liquefy up to 0.4 Bcf/d—reached FID in June

2024 and is expected to begin LNG exports in 2028.

Mexico: Developers

are currently constructing two LNG export projects in Mexico with a combined

capacity of 0.6 Bcf/d—the Fast LNG Altamira Floating LNG (FLNG)

production vessel (FLNG2), which has a capacity to liquefy up to 0.2 Bcf/d off

the east coast of Mexico, and Energía Costa Azul (0.4 Bcf/d export capacity) on

Mexico's west coast.

Both projects will

source feedgas from sources in the US.

Mexico’s first LNG export cargo was produced aboard Fast LNG Altamira FLNG1 in August 2024, and natural gas transported on the Sur de Texas-Tuxpan natural gas pipeline supplies this project. -OGN/TradeArabia News Service