GCC banks are benefitting from strong operating conditions supported by high oil prices, contained inflation and rising interest rates, but bank performance varies between markets, Fitch Ratings says.

UAE banks’ profitability has improved significantly, in contrast to that of Saudi and Qatari banks. We expect this improvement to be overall sustained, which, along with other solid financial metrics being maintained, could lead to positive rating actions on some UAE banks’ Viability Ratings.

Banks in the main GCC markets, Saudi Arabia, Qatar and the UAE, are geared positively towards rising interest rates. Most loan books reprice fairly quickly, while low-cost current and savings accounts (CASA) deposits represent a significant proportion of funding.

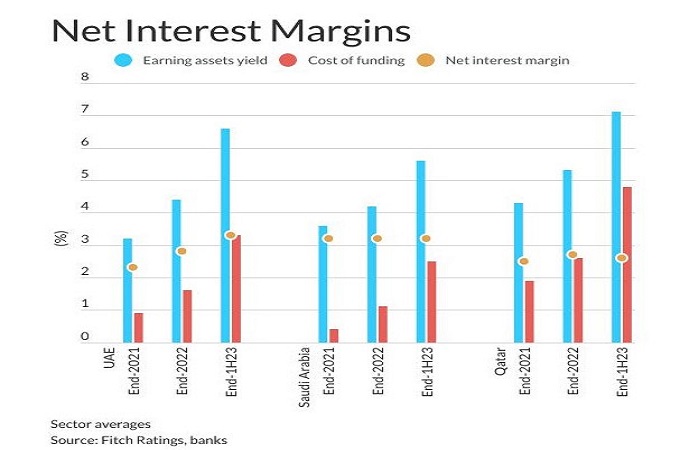

UAE banks have benefitted the most from rising rates, with average net interest margins (NIMs) 100bp higher in 1H23 than in 2020, compared with an 11bp increase for Qatari banks and little change for Saudi banks. As a result, UAE bank NIMs are now level with Saudi bank NIMs.

As we highlighted in July 2022, UAE banks are benefitting from healthy liquidity conditions, reflected in negative EIBOR-SAIBOR spreads. Liquidity is supported by high oil prices, foreign capital inflows and only moderate credit demand amid rising interest rates. We believe UAE bank NIMs have now peaked and will remain stable in 2H23, before declining slightly in 2024.

The lack of improvement in Saudi bank NIMs is mainly due to tighter liquidity, with financing growth in 2022 (14%) outpacing deposit growth (9%). Financing growth has largely been funded by term deposits, which cost more than CASA deposits.

Liquidity pressure moderated in 1H23 as financing growth slowed to 5%, and we expect NIMs to increase moderately in 2H23. However, Saudi bank financing growth is likely to be above the GCC average in 2023–2024 due to increasing corporate credit demand, and, with interest rates still high, we expect pressure on liquidity to prevent NIMs from rising much above 2H23 levels.

Qatari bank NIMs have improved only slightly, reflecting a higher reliance on price- and confidence-sensitive non-domestic funding. CASA deposits account for only 20% of sector funding, compared with over 50% in the UAE and Saudi Arabia.

New regulations penalising non-resident deposits in Basel III liquidity ratio calculations have increased competition for resident deposits, adding to funding costs, and the ability to pass higher rates to customers is hampered by exposures to highly indebted sectors.

NIMs are also dampened by weak credit demand and by the public sector continuing to repay its overdraft facilities. We expect NIM improvement to be minimal in 2H23 and 2024 as strong competition limits banks’ ability to reprice assets.

In the UAE and Saudi Arabia, asset quality metrics were stable in 1H23, supported by strong operating conditions. The average cost of risk in both countries has decreased since end-2021, but could increase in 2H23 and 2024 (although not to 2021 levels) as higher interest rates affect credit performance, particularly given recent fast growth in Saudi bank financing. UAE mortgage portfolios could be pressured given their high proportion of variable-rate loans, but the rise in property prices should keep losses-given-default close to nil.

In Qatar, the average annualised cost of risk was stable in 1H23 (106bp), but remains elevated due to muted credit growth and continued provisioning against vulnerable exposures in the real estate and construction sectors. It may increase given an average Stage 2 loans ratio above 10% and low specific Stage 2 coverage but we believe overall provisioning is adequate.

Weaker global growth and lower-than-expected oil prices are key risks for all GCC banking sectors. Fitch forecasts oil prices to average $80/barrel and $75/barrel in 2023 and 2024, respectively, which should remain supportive of operating conditions. – TradeArabia News Service