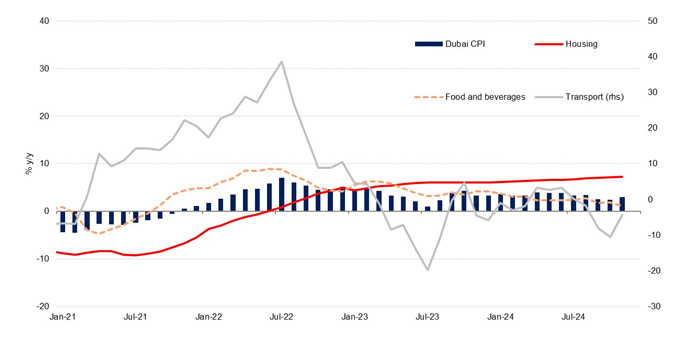

Dubai’s annual CPI (consumer price index) inflation rate accelerated to 3.0% y/y in November, up from 2.4% the previous month.

This marked the fastest pace of annual price growth since August, while on the monthly measure inflation was at 0.5%, up from 0.2% in October, according to Emirates NBD Research.

Over the year to date, headline annual inflation has averaged 3.3%, the same pace as seen in 2023. “Next year we forecast that price growth will slow to an average 2.8% y/y, with transport set to remain a drag on the headline measure but housing remaining the key driver,: said Emirates NBD.

Transport inflation

Transport inflation, which accounts for around 10% of the basket, was at -4.3% y/y in November, compared to -10.6% in October, which goes a long way to explaining the acceleration in headline inflation last month. Emirates NBD had anticipated this, holding that ‘the drag from transport has likely softened as petrol prices rose m/m for the first time since August.’ Nevertheless, the annual drag is still sizeable and it is expected that transport costs will continue to offset higher prices in other components of the basket through December and into next year given it is forecast that Brent futures will average $73/b in 2025, compared with a projected $80/b this year. The price of Super 98 petrol in December is AED2.61/litre, 4.7% lower m/m and 11.8% lower y/y.

Most other components of the CPI basket have remained fairly soft. Food & beverages prices were up 1.1% y/y in November, down from 1.8% in October and compared with a ytd average of 2.4%. Clothing & footwear costs were down y/y, as were tobacco and communication while household durables & maintenance prices were just 0.3% higher y/y.

The inflationary pressures from disrupted supply chains as shipping companies looked to avoid the Red Sea have largely dissipated now as firms have adjusted. Businesses polled for the Dubai S&P Global PMI survey reported cutting their output prices for the second month in a row in November even as input prices rose at a moderately faster pace, and the need to remain competitive should support lower prices for consumers in the months ahead.

Housing prices

As has been the case for the past several years, the primary driver of inflation in Dubai in November was housing prices, which were up 7.2% y/y, unchanged from the previous month. Housing accounts for around 40% of the basket, so the average 6.7% ytd has kept the headline measure more elevated than it would otherwise have been.

Annual rents were up 20.8% y/y in November and housing is likely to remain the key determinant of Dubai’s inflation metric.--TradeArabia News Service