Mubadala buys into German ophthalmic lens group Rodenstock

ABU DHABI, March 28, 2021

Abu Dhabi-based Mubadala Investment Company has announced plans to invest in Rodenstock Group, a leading manufacturer of premium ophthalmic lenses, as a minority investor alongside the funds advised by Apax.

Founded in 1877, Rodenstock has been a global leader in prescription lenses for over 140 years, with a strong track record of innovative product development and market leading technologies.

Headquartered in Munich, Germany, the company employs 4,900 people worldwide and is represented by sales subsidiaries and distribution partners in more than 85 countries.

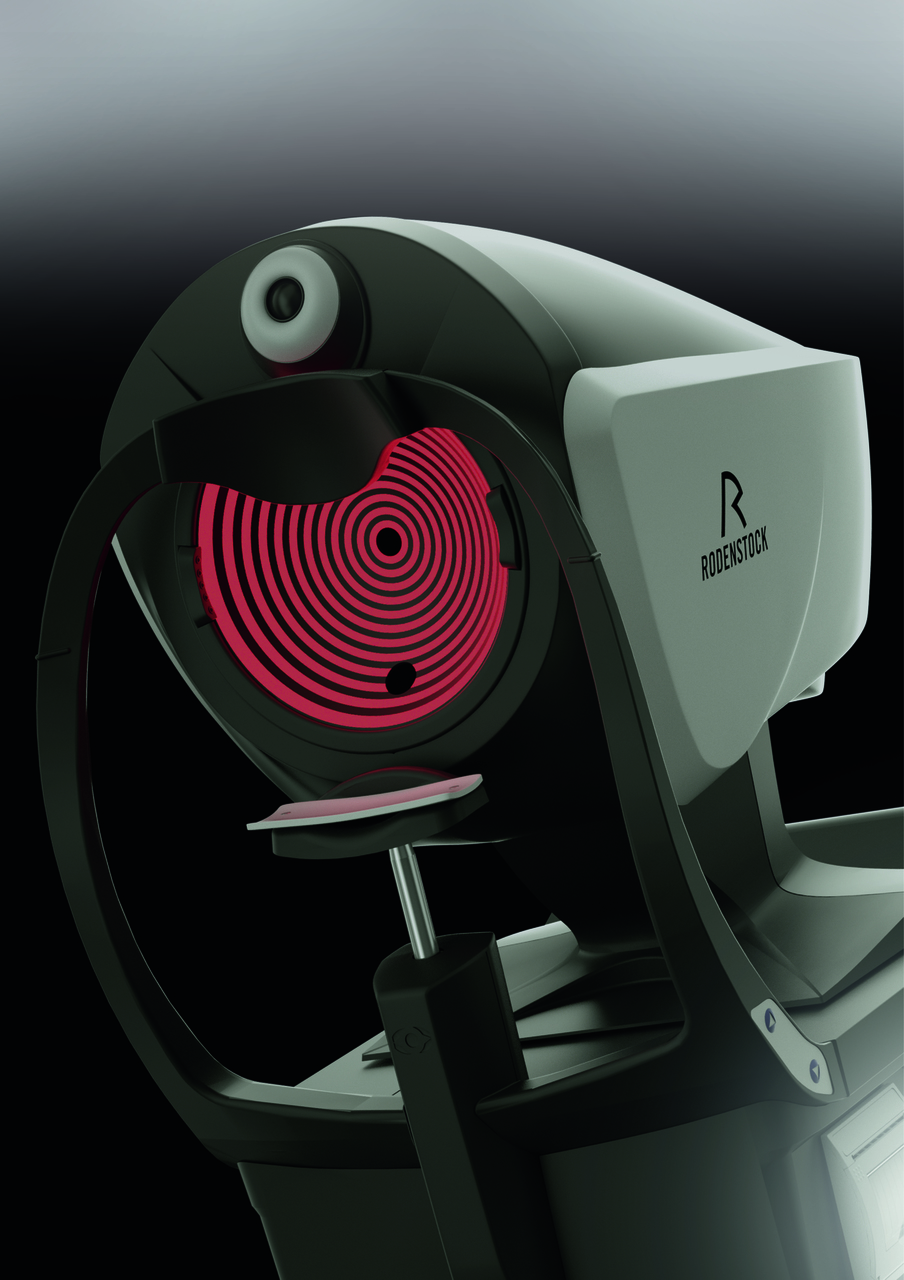

Rodenstock has a strong portfolio of innovative technologies; its patented “DNEye Pro” technology is at the heart of its business strategy, thus enabling the group to become the first company to measure the individual shape and size of each eye using thousands of data points.

The technology allows the company to produce individualized eyeglass lenses, called Biometric Intelligent Glasses. The company’s portfolio also includes eyewear under the Rodenstock and Porsche Design brands.

Camilla Macapili Languille, the Head of Life Sciences at Mubadala, said: "Rodenstock is the leading pure play lens manufacturer in the European market, with a strong reputation for innovation and a consistent focus on offering a differentiated customer proposition."

"We see its highly customized biometric lenses as only one part of its growing pipeline of proprietary technologies that will enable significant future growth. We are excited to be partnering with Apax and the management team to support the Company in this next stage of its journey," she noted.

Mina Hamoodi, the Senior VP of Life Sciences at Mubadala, said: "We will work in partnership with Apax to support the Rodenstock management team’s vision of accelerating the company’s growth through innovation, commercial execution and digitization, whilst continuing to deliver the highest level of service to clients and partners."

The transaction is subject to applicable regulatory approvals and is expected to close in the middle of 2021, stated Hamoodi.-TradeArabia News Service