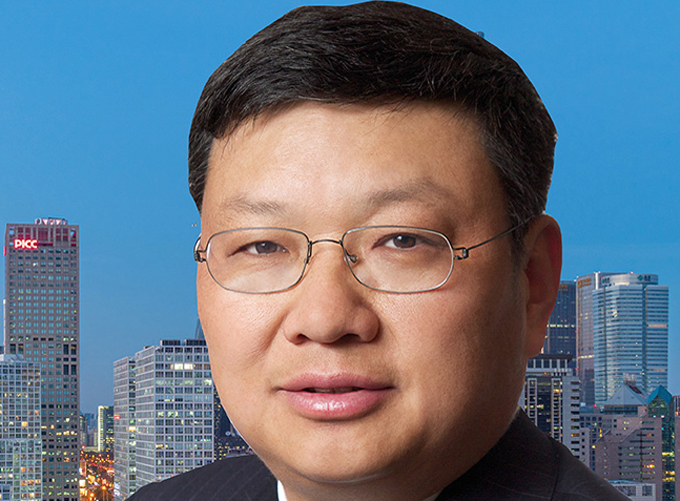

Singapore Gulf Bank (SGB), the digital bank backed by Mumtalakat and privately-held investment group Whampoa Group, has announced the appointment of Dr Xiang Bing as Independent Director to its Board.

Dr Bing joins SGB’s board alongside former Central Bank of Bahrain Deputy Governor, Shaikh Salman Bin Isa Al-Khalifa, and former JPMorgan senior executives, Ali Moosa and Edmund Lee.

Dr Bing is the Founding Dean and Professor of China Business and Globalisation at Cheung Kong Graduate School of Business (CKGSB), one of Asia's preeminent business schools and the first privately funded business school in China. Established in 2002, CKGSB is a premier business school with Harvard and Yale-educated faculty, campuses across China, and global offices in Hong Kong, New York, and London. Its distinguished alumni include the founder of Alibaba Group, Jack Ma, and the Chairman of Sinopec, Fu Chengyu.

Academic and business insights

Dr Bing's appointment brings valuable academic and business insights to SGB's board as the bank strengthens its position as a bridge between Asia and the MENA region. His expertise in Asian business and global markets will support SGB's mission to connect traditional and digital finance.

Edmund Lee, Founding Chairman of the Board of SGB, stated: "Dr Xiang's deep understanding of Asian business and his global perspective make him an ideal addition to our board as we build financial infrastructure for the future."

Dr Bing added: "The growing opportunities from Asian and Middle Eastern markets represent an extraordinary moment for financial innovation. SGB’s initiative to deliver round-the-clock settlement capabilities and efficient cross border payment services will enhance financial accessibility and integration. I look forward to contributing to SGB's mission to strengthen the connectivity between these dynamic regions to advance digital finance globally."

Following the recent launch of its corporate banking services, SGB is pioneering a new era of banking where everyone can easily access and manage digital assets alongside traditional assets within one integrated network. Underpinned by its compliance-first approach, SGB will serve as a vital link between mainstream financial services and the rapidly advancing digital asset economy, empowering the next billion users with access to the future of finance.--TradeArabia News Service