DGCX volumes continue growth in February

DUBAI, March 2, 2017

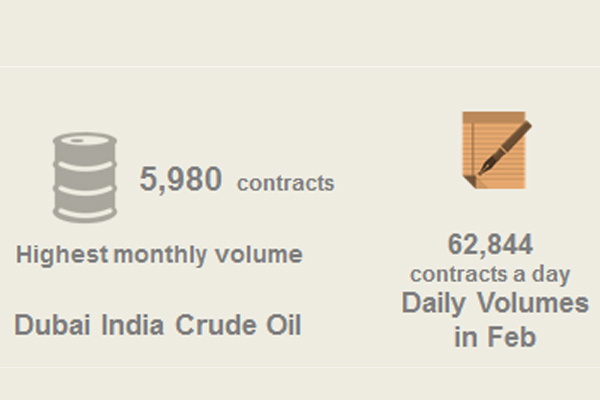

Daily trading volumes on the Dubai Gold & Commodities Exchange (DGCX) in February amounted to 62,844 contracts per day, the exchange said.

Trading activity on the exchange’s Indian products remained consistent on the back of increased volatility in Indian markets due to the Union Budget announcement made at the beginning of the month and the ongoing state elections in India.

The DGCX Indian product suite, particularly the Indian Rupee Options contract recorded notable year-on-year growth of 92 per cent with just under 50,000 lots trading and also recorded the highest monthly Average Open Interest (OI) of 23,275 contracts, signifying increased interest and liquidity.

Dubai India Crude Oil futures also registered the highest monthly volume of 5,980 contracts in February 2017. This helped energy products on DGCX record a combined volume of 17,139 contracts. This highlights that investors and traders have started reacting favorably to the DGCX value proposition in offering global products in Energy, Gold and Currencies under one roof in a capital efficient, cost effective and safe manner.

Gaurang Desai, CEO of DGCX, commented: “Indian Union Budget proposals and the ongoing state assembly elections have stirred volatility in Indian markets. Since many of our products are geared towards offshore investors, we often see spikes of trading activity in our Indian referenced contracts, which highlights the importance of these products for hedging purposes in a period when financial markets are experiencing sharp volatility.

“Volatility is likely to trend higher through the course of the year as markets react to a range of unknowns including the anticipated US Federal Reserve rate hike in March, the upcoming European elections and the impact of US policy changes. In light of these events, we will continue to strongly push forward our agenda of providing market participants with a diverse array of products and solutions which will not only help them to effectively manage their risk, but also protect them from rapid market fluctuations and the prevailing economic uncertainty.”

During the month the DGCX also announced its Trading Campus initiative in collaboration with Envision Training Centre that is aimed at education and creating awareness about financial products, derivatives trading, and various trading techniques. This initiative will play an important role in furthering DGCX’s goal to ensure that traders and investors are not only able to trade responsibly but also are equipped with the skill-set needed to trade financial products.

DGCX plans to list more Single Stock Futures as well as energy products in the second quarter of 2017 which will attract more investors and increase participation on the exchange’s trading platform, it said. – TradeArabia News Service