Cryptocurrencies: Bubble or no bubble

DUBAI, February 22, 2018

A cryptocurrency is a speculative instrument, and a collapse in its market value would be just a ripple across the financial services industry, too small to disturb stability or affect the creditworthiness of banks, said S&P Global Ratings.

A cryptocurrency, in its current version, is a speculative instrument, and a collapse in its market value would be just a ripple across the financial services industry, too small to disturb stability or affect the creditworthiness of banks, said S&P Global Ratings in a new report.

Cryptocurrencies are digital currencies that use encryption techniques to regulate the generation of units of currency and verify the transfer of funds, added the RatingsDirect report.

They have attracted a significant amount of attention from the market over the past 12 months. Cryptocurrencies are independent from central banks, and the risk of them infiltrating the traditional financial systems, exposing them to a possible bubble burst, is raising eyebrows at regulators.

If the value of cryptocurrencies dropped substantially, retail investors would endure most of the impact, while rated banks wouldn't feel the hit since they are largely insulated thanks to their limited direct and indirect exposures and cautious approach so far.

The future of cryptocurrencies will depend on the coordinated approach of global regulators and policymakers, but we note that their underpinning technology could strengthen operations, notably with regards to money transfers and financial market infrastructure companies.

Cryptocurrencies do not meet the basic two requisites of a currency: An effective mean of exchange and an effective store of value. First, cryptocurrencies are still not widely accepted as payment instruments, although the list of companies accepting them has increased over the past few years. Second, the volatility that we have observed over the past 12 months in the valuation of some cryptocurrencies and their market cap is the most meaningful evidence that they fail the test of value storage.

For example, in the first 10 days of February 2018, the market cap of cryptocurrencies dropped by around $185 billion from Jan. 28, 2018.

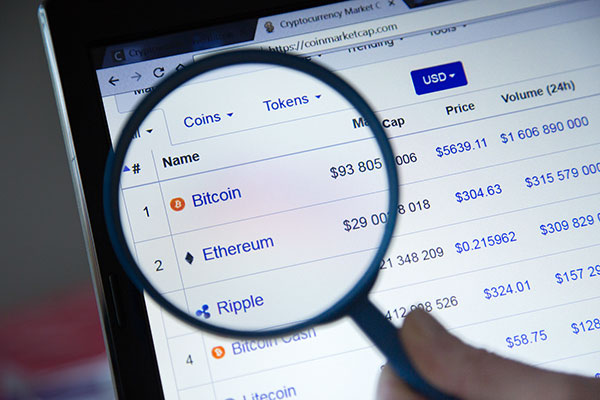

S&P also doesn’t view cryptocurrencies as an asset class. For starters, the total outstanding aren't big enough yet. At Feb. 10, 2018, there were 1,523 outstanding cryptocurrencies with a market cap of around $394 billion. By way of comparison, at the same date, this is well below the market capitalization of Apple Inc., around $794 billion.

The oldest and most renowned cryptocurrency is Bitcoin, which emerged in the aftermath of the global financial crisis as a decentralized peer-to-peer payment instrument. It intended to restore the credibility of the payment system by removing intermediaries such as banks and central banks from the equation and relying on end users' powered network.

Bitcoin was originally used as a means of payment for transactions but its credibility dipped when it was allegedly associated with illegal transactions. Bitcoin and other cryptocurrencies reemerged in 2017 when their market cap increased exponentially. However, we believe that their usage changed from a payment instrument to a speculative instrument when buyers began to largely bet on their future value instead of using them for transactions.

Bubble or no bubble

Cryptocurrencies are most like a speculative instrument, versus an asset class or a currency. S&P Global is of the view that the current version has many characteristics of a traditional bubble, mainly based on the following three reasons:

• The offer of the oldest cryptocurrency (Bitcoin) is limited by definition to 21 million coins of which around 16.9 million are already in circulation. One could argue that an infinite number of cryptocurrencies could be created, but we believe that this process takes time, as these currencies need to earn their credibility. As such, the top 10 cryptocurrencies represent roughly 80 per cent of their total market cap.

• The volatility of the value of cryptocurrencies is extremely high. Over the past 12 months, cryptocurrencies' market cap has increased 33x from $17 billion to $579 billion at Jan. 28, 2018 compared with an increase of 1.4X over 2014-2016. In the first 10 days of February 2018, the market cap dropped by around $185 billion reaching $394 billion.

That was reportedly underpinned by the crackdown of some countries, particularly China and South Korea. Moreover, the single-name concentration in the holdings of these instruments is high. For example, at Feb. 10, 2018, 1,650 users (addresses) with more than 1,000 Bitcoins in their portfolio controlled as much Bitcoins as the 26.3 million users with less than 100 Bitcoins in their portfolios. We believe that this concentration, along with the unregulated nature of this instrument makes it prone to market manipulation for example.

• Finally, cryptocurrencies do not benefit from the backing of cash flows or a credible central issuer, which would give it an intrinsic value. Market perception/sentiment rather drives their valuation.

If cryptocurrencies were to take off and become an effective currency issued in a decentralized manner, the impact on monetary policy implementation would be deep, since central banks might lose their ability to control money supply.

Conversely, if central banks were to back cryptocurrencies, the central banks would be better positioned to predict money demand and therefore adjust supply accordingly. It is still too early to tell in which direction this instruments will move. – TradeArabia News Service