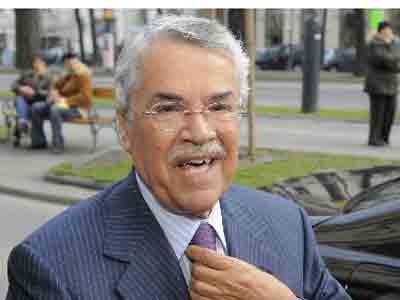

Al Naimi ... making a point

Saudis give free-marketers dose of their medicine

LONDON, December 24, 2014

Attention all oil producers: Saudi Arabia wants to tell you something. If a truly free market sets the price, it will be far too low for comfort. Ali Al Naimi, the kingdom's oil minister, wants others to share the discipline needed for a healthy cartel.

Al Naimi told the Middle East Economic Survey (MEES) that "it is not in the interest of Opec producers to cut their production, whatever the price is." Disappointingly for conspiracy theorists that see a Saudi-Western plot to weaken undesirable regimes via depressed oil prices, he said his motivation was driven by economics, not politics. Free-riders should pay a little for the privilege of high profits.

The oil minister has a point. If Saudi Arabia and other very low-cost producers went flat out for cheap volume – as they would in a totally free market – the world's needs could probably have been met with crude at $20 a barrel. That is the price in current dollars which prevailed before Opec first showed what a strong cartel can do in 1973. It is well below what it needed for shale oil and deep sea drilling to make economic sense.

The monthly inflation-adjusted average price since 1973 has been $58. Much of the credit goes to Saudi Arabia, which has led by doing – cutting production as and when needed.

The Saudis are once again doing, this time by not cutting production. Their argument is compelling. In the long term, they think it is unfair for higher-cost producers, most notably US shale oil drillers, to grow at their expense. The Saudis want to maintain their market share.

More immediately, they are willing to take a good bit of pain to make the point that less economical producers should help bring the market back into balance at a desirable price. A taste of market medicine may persuade them to cooperate, if only tacitly.

The Saudis may well succeed. They and their allies in the Gulf probably have enough foreign currency reserves to bear low prices long enough to disrupt the U.S. industry's growth and to persuade cash-needy Russia and Mexico to do their bit. They will learn that for producers, free markets may be fine in theory, not in practice.

Saudi Arabia convinced its fellow Opec members that it is not in the group's interest to cut oil output however far prices may fall, the kingdom's Oil Minister Ali Al Naimi said in an interview with the MEES on December 22. "As a policy for Opec, and I convinced Opec of this, even Al Badri (the Opec secretary general) is now convinced, it is not in the interest of Opec producers to cut their production, whatever the price is," Al Naimi was quoted by MEES as saying.

"Whether it goes down to $20, $40, $50, $60, it is irrelevant," he said.

An Arab oil source told Reuters on the sidelines of a meeting in Abu Dhabi of the Organization of the Arab Petroleum Exporting Countries (OAPEC) that without more discipline from non-members of Opec, "Every time prices fall, we would be asked to cut." --Reuters