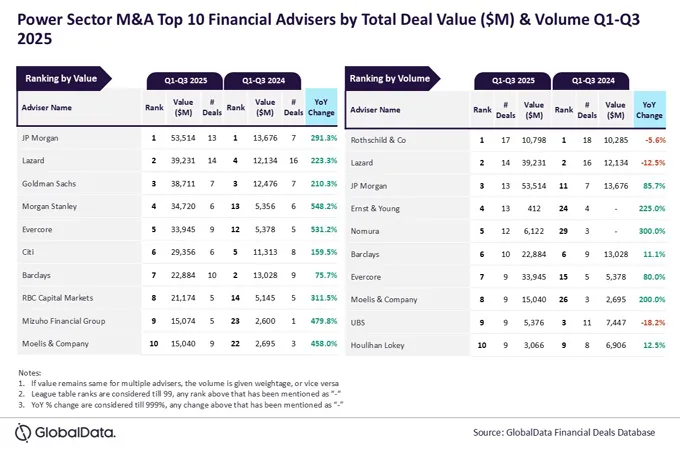

GlobalData has announced the latest Financial and Legal Adviser League Tables, which rank advisers by the total value and volume of merger and acquisition (M&A) deals they advised on in the power sector during Q1-Q3 2025.

Financial Advisers

JP Morgan and Rothschild

& Co were the top mergers and acquisitions (M&A) financial advisers in

the power sector during the first three quarters (Q1-Q3) of 2025 by value and

volume, respectively, according to the latest financial advisers league table

by GlobalData, a leading data and analytics company.

An analysis of

GlobalData’s Financial Deals Database reveals that JP Morgan achieved

the leading position in terms of value by advising on $53.5 billion worth of

deals. Meanwhile, Rothschild & Co led in terms of volume by advising on a

total of 17 deals.

Aurojyoti Bose, Lead

Analyst at GlobalData, comments: “JP Morgan and Rothschild & Co were the

top advisers by value and volume, respectively, during Q1-Q3 2024 as well.

While the total number of deals advised by Rothschild & Co remained

relatively stable during Q1-Q3 2025 compared to Q1-Q3 2024, JP Morgan

registered more than a three-fold year-on-year jump in the total value of deals

advised by it during the reporting period.

“Eight of the 13 deals

advised by JP Morgan during Q1-Q3 2025 were billion-dollar deals*, which also

included three mega deals valued more than $10 billion. The involvement in

these big-ticket deals helped JP Morgan register a massive jump in terms of value."

Lazard occupied the

second position in terms of value, by advising on $39.2 billion worth of deals,

followed by Goldman Sachs with $38.7 billion, Morgan Stanley with $34.7 billion

and Evercore with $33.9 billion.

Meanwhile, Lazard

occupied the second position in terms of volume with 14 deals, followed by JP

Morgan with 13 deals, Ernst & Young with 13 deals and Nomura with 12 deals.

Legal Advisers

White & Case and Kirkland

& Ellis were the top mergers and acquisitions (M&A) legal advisers in

the power sector during the first three quarters (Q1-Q3) of 2025 by value and

volume, respectively, according to the latest legal advisers league table by GlobalData,

a leading data and analytics company.

An analysis of

GlobalData’s Financial Deals Database reveals that White & Case

achieved the leading position in terms of value by advising on $45.7 billion

worth of deals. Meanwhile, Kirkland & Ellis led in terms of volume by

advising on a total of 26 deals.

Aurojyoti Bose, Lead

Analyst at GlobalData, comments: “Interestingly, there are many similarities

between the performance of White & Case and Kirkland & Ellis. Apart

from leading by value, White & Case occupied the second position by volume

during Q1-Q3 2025. Similarly, Kirkland & Ellis, apart from leading by

volume, occupied the second position by value during the same period.

“Both the law firms registered year-on-year improvement in terms of deal volume and value, and subsequently improvement in their respective ranking by these metrics. They were also involved in several big-ticket deals during Q1-Q3 2025 and in some cases, they even advised on the same high-value deal. For instance, both Kirkland & Ellis and White & Case advised on $16.4 billion deal for the acquisition of Calpine by Constellation Energy.”

Kirkland & Ellis

occupied the second position in terms of value, by advising on $45.3 billion

worth of deals, followed by Gibson, Dunn & Crutcher with $35.7 billion,

Latham & Watkins with $24 billion, and Debevoise & Plimpton and Fried,

Frank, Harris, Shriver & Jacobson jointly occupying the fifth position with

each advising on a deal worth $16.4 billion.

Meanwhile, White &

Case occupied the second position in terms of volume with 23 deals, followed by

CMS with 23 deals, Latham & Watkins with 21 deals and Dentons with 19

deals. -TradeArabia News Service